About Changes

We deal in change. Almost all of our clients come to us to effect a significant change in their lives – adoption, separation, divorce, and more.

These changes are almost always positive – regardless of how it seems at the time. But changes like those we work on everyday necessitate other changes.

How important is it? Very. We know changing wills, health care proxies, and/or pension and insurance beneficiaries are not the first thing on anyone’s mind at any time Most people make a will and file it in a dusty drawer for years without ever thinking about it again. Sometimes that’s fine. Most times it’s not.

Because wills don’t’ automatically change to match circumstances and unlike insurance and pensions you don’t get a notice from a company telling you to check that things are current.

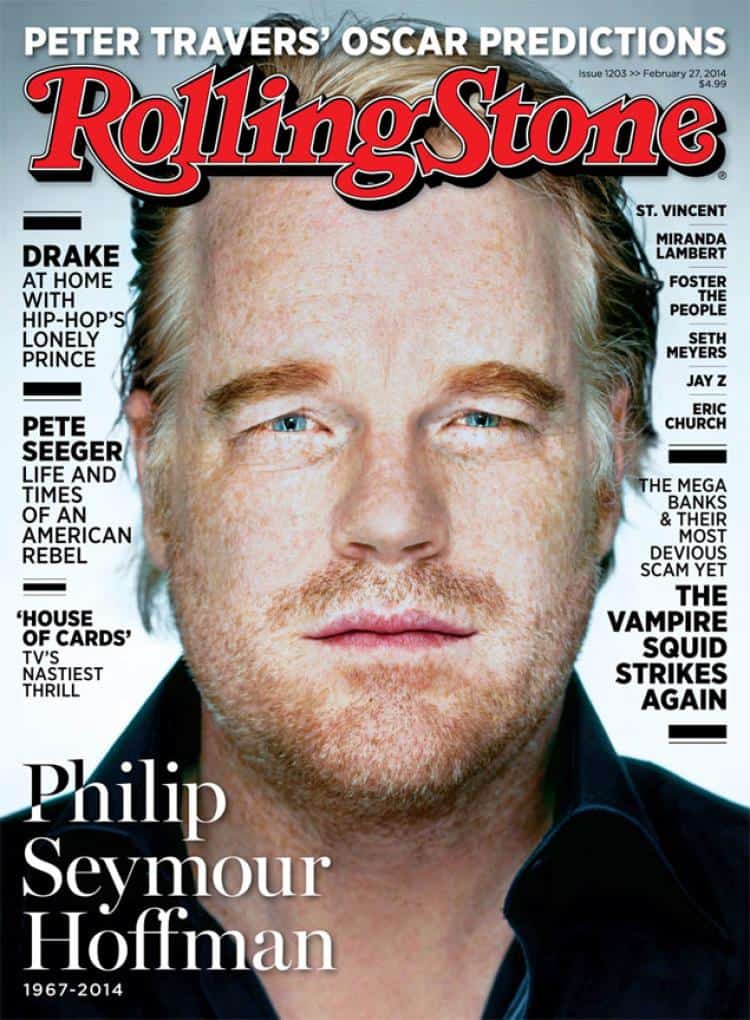

Forgetting to make a change can be catastrophic. Just check in with the estate of one of the great actors of our time who died too early – Philip Seymour Hoffman.

The good news was that even though both actors died so unexpectedly they had wills even though they weren’t married. The bad news is that they executed wills around the time they both broke through in their careers then never updated them.

When Hoffman made his will in 2004 he was in a long-term relationship and had one child. The will left everything to his companion, Marianne O’Donnell, and their son. When he died in 2014, Hoffman was still with O’Donnell and they had two more children.

Because the will only mentioned his son, the estate is hamstrung, it does not have the options it should to take care of O’Donnell and the children without crippling taxes. Apparently, Hoffman did not believe in marriage, which would not have been a problem with the estate had he simply updated his will upon the birth of each child.

As it stands now, the estate has the choice of paying those enormous taxes or setting up a trust solely for the benefit of Hoffman’s son and hope that he provides for the family. Hoffman’s son is thirteen.

Perhaps in all of law there is nothing easier to fix before the fact…. please call us for a free consult.